For millions of Americans, the pursuit of higher education has come with a staggering price tag. In Texas, the burden of student loans is a daily reality for recent graduates, established professionals, and families alike. Whether you are navigating complex federal regulations or facing aggressive collection tactics from private lenders, the stress can feel overwhelming.

Many borrowers suffer in silence, unaware that strong legal protections exist to shield them from predatory practices and unmanageable debt. Understanding Your Rights is the first step toward regaining financial freedom. You are not at the mercy of your servicers, and you do not have to face this battle alone.

At Cannon Legal PLLC, we believe that everyone deserves skilled advocacy when navigating complex financial disputes. This guide explores your protections under federal and Texas law, explains the critical differences between repayment, forbearance, and deferment, and details how a dedicated attorney can help you pursue loan discharge or defend against lawsuits.

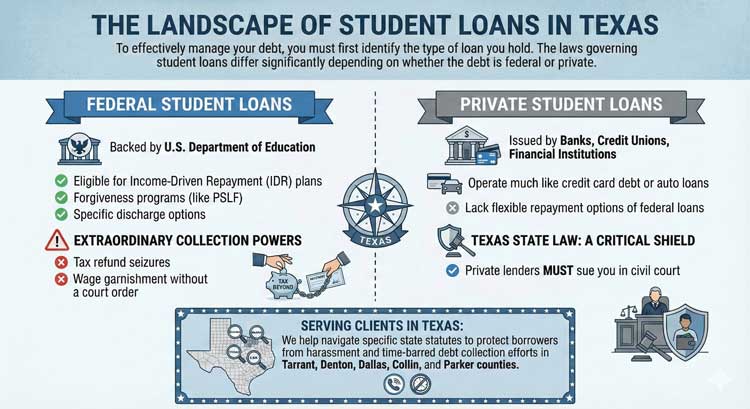

The Landscape of Student Loans in Texas

To effectively manage your debt, you must first identify the type of loan you hold. The laws governing student loans differ significantly depending on whether the debt is federal or private.

Federal Student Loans

Backed by the U.S. Department of Education, these loans offer the most robust consumer protections. They are eligible for Income-Driven Repayment (IDR) plans, forgiveness programs (like PSLF), and specific discharge options. However, the government has extraordinary collection powers, including tax refund seizures and wage garnishment without a court order.

Private Student Loans

These are issued by banks, credit unions, or other financial institutions. Private student loans operate much like credit card debt or auto loans. While they lack the flexible repayment options of federal loans, private lenders must sue you in civil court to garnish wages or seize assets. This is where Texas state law becomes a critical shield for consumers.

In Texas, we serve clients in Tarrant, Denton, Dallas, Collin, and Parker counties, helping them navigate the specific state statutes that protect borrowers from harassment and time-barred debt collection efforts.

Navigating Repayment Options

If you are struggling to make monthly payments, simply stopping payment is the worst option. Instead, you should proactively explore structured repayment plans.

Income-Driven Repayment (IDR)

For federal loans, IDR plans cap your monthly payment at a percentage of your discretionary income. In some cases, your payment could be as low as $0. These plans also offer a path to forgiveness after 20 or 25 years of qualifying payments.

Refinancing and Consolidation

-

Consolidation: Combines multiple federal loans into one, potentially opening up eligibility for different repayment plans.

-

Refinancing: Involves taking a new private loan to pay off existing federal or private loans. Warning: Refinancing federal loans into a private loan strips you of federal protections like IDR and forgiveness.

Private Loan Modification

Private lenders are not required to offer income-based repayment. However, an attorney can often negotiate a modification or settlement on your behalf, especially if the loan is in default or if the lender fears they may lose a lawsuit due to documentation errors.

The “Pause” Buttons: Forbearance and Deferment

When financial hardship strikes, you may need a temporary break from payments. It is vital to understand the difference between forbearance and deferment, as choosing the wrong one can increase your total debt.

Deferment

Deferment is generally the better option. If you have subsidized federal loans, the government pays the interest while your loans are in deferment. Common reasons for eligibility include:

-

Returning to school half-time.

-

Unemployment.

-

Economic hardship.

-

Active duty military service (Our firm proudly advocates for military members and service families ).

Forbearance

Forbearance allows you to stop making payments or reduce your monthly payment for up to 12 months. However, unlike deferment, interest continues to accrue on all loan types. This interest is often “capitalized” (added to your principal balance) at the end of the period, meaning you will pay interest on your interest.

Key Takeaway: Use forbearance only as a last resort. If you are facing long-term financial difficulty, an IDR plan is usually a superior choice to avoiding the “interest trap.”

The Path to Loan Discharge

While “forgiveness” usually implies completing a repayment term, loan discharge eliminates the debt immediately due to specific circumstances. This is a complex legal area where having an attorney is invaluable.

1. Borrower Defense to Repayment

If your school misled you or engaged in misconduct related to your loan or the educational services provided, you might be eligible for a discharge. This is common with predatory for-profit colleges.

2. Total and Permanent Disability (TPD) Discharge

If you are unable to work due to a total and permanent disability, you can apply to have your federal student loans discharged.

3. Closed School Discharge

If your school closed while you were enrolled or shortly after you withdrew, you are not responsible for the debt incurred at that institution.

4. Bankruptcy Discharge

There is a pervasive myth that student loans cannot be discharged in bankruptcy. While difficult, it is not impossible. You must prove “undue hardship” through an adversary proceeding. Recent Department of Justice guidelines have made this process slightly more accessible for federal loans. Our bankruptcy services provide relief for those overwhelmed by debt, offering a path toward financial stability.

How Cannon Legal PLLC Can Help

Cannon Legal PLLC is a nationwide law firm dedicated to protecting consumers facing financial challenges. Our firm managing attorney, John Helstowski, has been licensed in Texas since 2011 and leads a team committed to leveling the playing field against powerful creditors.

We combine deep legal knowledge with a client-centered approach. Whether you are dealing with student loans, merchant cash advances, or identity theft, our mission is to provide strong legal representation and restore your peace of mind.

We serve clients across Texas, including:

-

Dallas

-

Fort Worth

-

Colleyville

-

Plano

-

Denton

- Arlington

- Houston

- San Antonio

We understand that student loans are more than just a bill—they are a barrier to your life goals. We challenge lending practices and provide the critical support you need.

Conclusion: Take Control of Your Financial Future

Ignoring student loans will not make them disappear, but taking action can change your financial trajectory. Whether you need clarity on Understanding Your Rights, assistance with repayment negotiations, or a fierce defense against a lawsuit, Cannon Legal PLLC is your trusted ally.

Don’t let lenders dictate your future. If you are in Dallas, Colleyville, or anywhere in the surrounding counties, reach out to us. We will review your case, explain your options for deferment, forbearance, or loan discharge, and fight to protect your financial well-being.

Ready to discuss your options? Call us today at (800) 890-8585 or schedule your appointment online at can.tocall.me. Let us help you move forward with confidence.