It is imperative that our emails reach you so that you can complete your credit prelitigation process faster.

You will be receiving emails from cs@texascreditlaw.com..

Please find out email provider below to learn how to whitelist our emails:

AOL 7.0 & 8.0

- Open a message from the@texascreditlaw.com or cs@creditprelitigation.com.

- Click the Add Address icon on the right side of the window.

- Click the Save button

AOL 9.0 and Up

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com

- Click the Add Address icon on the right side of the window

- Click the OK button

AOL Mail

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com.

- Click Show Images: Always for this sender

AT&T Webmail and BellSouth

- In your mailbox, click Options.

- Go to Mail Options, select Filters. Click Add Filter.

- Go to From Header and select Contains. Enter@texascreditlaw.com or cs@creditprelitigation.com (email or website) in the box provided.

- Go to the drop down menu at the bottom with the option Move the message to. Select Inbox.

- Click Add Filter

Comcast SmartZone

- Click Address Book

- Click New. Select New Contact

- Add @texascreditlaw.com or cs@creditprelitigation.com.

- Click Save

Cox Email

- Click Preferences.

- Go to General Email Preferences and click Blocked Senders.

- Type @texascreditlaw.com or cs@creditprelitigation.com to add to the Exceptions list.

- Click Add. Click Save.

EarthLink

- Click on Address Book (it’s over on the left, below your Folders).

- When your Address Book opens, click the Add new contact.

- On the Add Contact screen, find the Internet Information box.

- Enter the @texascreditlaw.com or cs@creditprelitigation.com into the top Email box.

- Click Save.

Earthlink Total Access

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com

- In the From field, right-click the email address

- Click the Add to Address Book link in the menu

- Click the Ok button

- Open a message from the desired sender.

- Click Always display images from (senders address).

OR

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com.

- Click the arrow next to reply on the top right.

- Click Add sender to contact list.

Hotmail

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com.

- Click Mark as safe next to the From name and address.

- Now click Add contact.

Mac Mail

- Open a message from the @txclf.com or cs@creditprelitigation.com

- Go to Message in the top tool bar

- Click Add Sender to Address Book from the drop-down menu

McAfee SpamKiller

- Go to Friends and click Add.

- Type @texascreditlaw.com or cs@creditprelitigation.com in the space provided. Click OK.

MSN

- Click on Help & Settings

- Click Email Settings

- Click on Safe List

- In Add an item to this list, type xxx@texascreditlaw.com or cs@creditprelitigation.com (note: xxxx has to be replaced with the domain)

- Click Add

Thunderbird / Netscape 6 or 7

- Open a message from the desired sender.

- In the From field, right-click the @texascreditlaw.com or cs@creditprelitigation.com

- Click the Add to Address Book link in the menu.

- Click the OK button.

NetZero

- Go to Options and click Safe List.

- Type@texascreditlaw.com or cs@creditprelitigation.com in Add Address to Safe List.

- Click Add then click Save.

Norton AntiSpam

- Go to the Status & Settings tab and click AntiSpam.

- Click Configure and go to the Allowed List tab.

- Click Add and type @texascreditlaw.com or cs@creditprelitigation.com in the Email Address box.

- Click OK.

Outlook 2003 – 2007

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com.

- Go to the Actions option in the top tool bar.

- Select Junk E-mail from the drop down menu.

- Select the Add Sender to Safe Senders List option.

Outlook 2000 / Outlook 11

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com

- In the From field, right-click the email address

- Click the Add to Contacts link in the menu

- Click the OK button

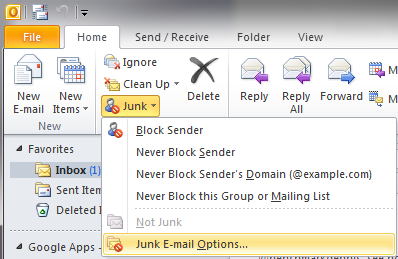

Outlook 2010 / Outlook 2013

- Open Microsoft Outlook 2010 / 2013

- In the home tab, click the Junk drop down menu

- Then click Junk Email Options

- Navigate to the Safe Recipients tab

- Click the Add button

- Type in @texascreditlaw.com or cs@creditprelitigation.com you want to whitelist, then click okay

Outlook Express 6

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com

- In the From field, right-click the email address

- Click the Add to Address Book link in the menu

- Click the OK button

Road Runner

- Open Junk Mail folder.

- Select emails (@texascreditlaw.com or cs@creditprelitigation.com) you wish to add to your whitelist.

- Click Mark as Not Spam.

Spam Assassin

- In your hard drive, find your Spam Assassin folder. Click the folder.

- Open the file named user_prefs with a text editor or Notepad. (If the file does not exist you can create it using the instructions on Spam Assassin’s website.)

- Make a new line with the text whitelist_from and @texascreditlaw.com or cs@creditprelitigation.com

- Save the file and close it.

Verizon

- Go to Options and select Block Senders.

- In the Safe List, type in @texascreditlaw.com or cs@creditprelitigation.com

- Click OK.

Windows Live

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com

- Click Mark as safe next to the From name and address

- Now click Add contact

Yahoo!

- Open a message from the @texascreditlaw.com or cs@creditprelitigation.com.

- Now click Add contact next to the From name and address.