Stop Dovenmuehle Mortgage, Inc. foreclosure in Texas

Approximately one year ago I was facing foreclosure through a reverse mortgage company, this entire staff associate with this law firm worked my case for approximately a year to help me safe my home from being foreclosed. I will be forever grateful for the extra time they put in to assist me through out the entirety of this case. I would highly recommend them to anyone that is facing similar issues they really are like family everyone played a vital role with me winning my case. The open communication, the phone calls to keep me updated on every step of the process was comfirmation to me that I had choosen the right legal team. Thank you all so much for a job well done.

The law firm treated me and my family like a family and not one that just wanted the money we fought to the end . I will also remember and I will always refer them to anybody I know.

Inspires great confidence. Can be a real alternative to filing bankruptcy, but will not be for everyone. Call for the free consultation to weigh your options.

J Gannon Helstowski and his firm have represented my interest on several occasions. They have always provided me all the facts needed to make real time decisions to my best interest. Lead council and his team co council Jason Taylor and Litigation Mgr Ron Monroe lead an energetic and professional staff of paralegals always ready to respond to your inquiries and reach out to you regarding your case proactively to keep you ahead of issues. I highly recommend the firm for its family oriented approach and dedication to your legal success .

Bankruptcy is not the only way to stop Dovenmuehle Mortgage, Inc. foreclosure in Texas

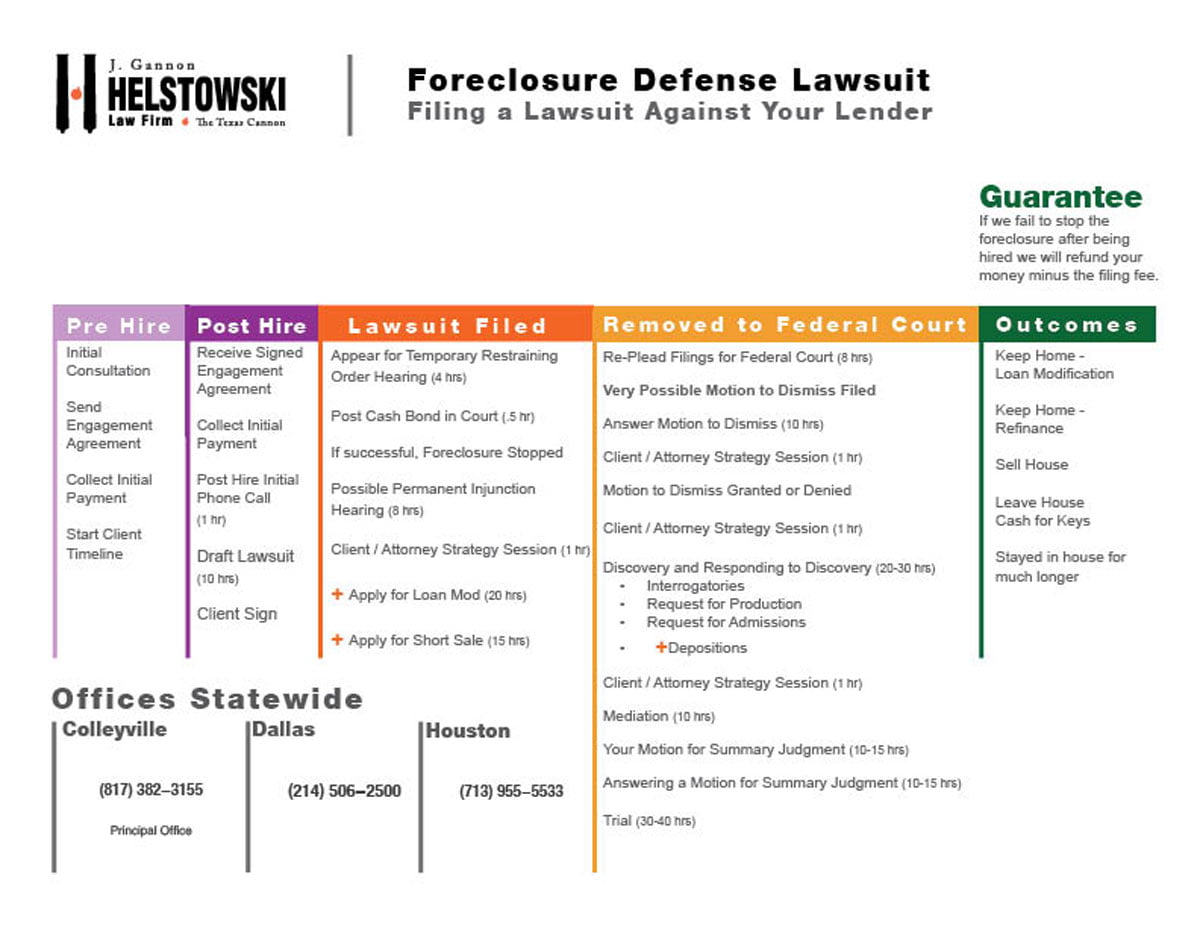

To stop Dovenmuehle Mortgage, Inc. foreclosure many Texas homeowners choose to file a lawsuit against Dovenmuehle Mortgage, Inc. rather than file a Stop Foreclosure without filing bankruptcy. The J. Gannon Helstowski Law Firm files lawsuits against Dovenmuehle Mortgage, Inc. and asks the judge to agree to stop the foreclosure. We offer a Money Back Guarantee that if we do not stop your foreclosure we will refund all the fees you paid us minus the filing fees of the lawsuit. We offer aggressive representation of you against Dovenmuehle Mortgage, Inc..

While each stop foreclosure lawsuit is unique, most follow the same pattern:

File Stop Dovenmuehle Mortgage, Inc. Foreclosure Lawsuit

We will first gather all the details of your situation and make sure that we believe a successful outcome is possible with Dovenmuehle Mortgage, Inc. in our Initial Consultation (IC). If you decide to hire our firm you will be assigned a case manager and attorney to work your case. They will gather the documents needed from you and begin drafting your lawsuit. You will need to be available to answer questions and review a copy of your lawsuit before filing. Once filed, your assigned attorney will appear before a judge to request that a Temporary Restraining Order (TRO) be granted. If the judge signs the TRO, we will pay the bond and notice Dovenmuehle Mortgage, Inc. that the foreclosure must be stopped.

Once the TRO is granted we will begin working hard for you to achieve a permanent resolution with Dovenmuehle Mortgage, Inc.. Outcomes can include keep your home with a loan modification, keep your home with a refinance, sell your house and keep the equity, possible short sale, leave your house for cash for keys, or stay in your home for a longer duration.

Your Lawsuit is Removed to Federal Court

Often a lender will ask the judge to remove your case to Federal Court. If the judge agrees, it will cost more the pursue your claims against Dovenmuehle Mortgage, Inc.. Federal court has many strict guidelines and rules that must be followed to keep your case alive. We will have to represent you in a couple of likely motions that the Dovenmuehle Mortgage, Inc. will file in the case. We will answer the Motion to Dismiss and Motion for Summary Judgment for you if you retain us to represent you in Federal Court.

Resolution of your case

While a majority of the cases end in Dovenmuehle Mortgage, Inc. offering a loan modification or terms that allow our clients to keep their home, they may not be able to take advantage of the opportunity. Some possible options to resolving the case are:

Permanent Loan Modification to Keep Home – A loan modification maybe offered that allows the homeowner to keep the home at a monthly mortgage payment that they can afford. The permanent modification will replace the existing mortgage with new terms.

Sale of House – By filing a lawsuit against Dovenmuehle Mortgage, Inc., you can possibly negotiate a principal reduction that allows you to sale the home at a small profit. A lawsuit can also possibly allow time to sale the house at a better price.

Short Sale of House – By filing a lawsuit against your lender, you can possibly use the time that allows you to sale the home and avoid more credit problems and a large mortgage deficiency balance.

Cash for Keys – After filing a lawsuit against Dovenmuehle Mortgage, Inc. and your other options fail, you may be able to obtain a larger Cash for Keys settlement with the lender.

Staying in Home for an extended time – After filing a lawsuit against your lender and all your other options fail, you have stayed in your property for a much longer duration that may allow you to put yourself in a better position to move on.