Bankruptcy is not the only way to stop foreclosure in Texas

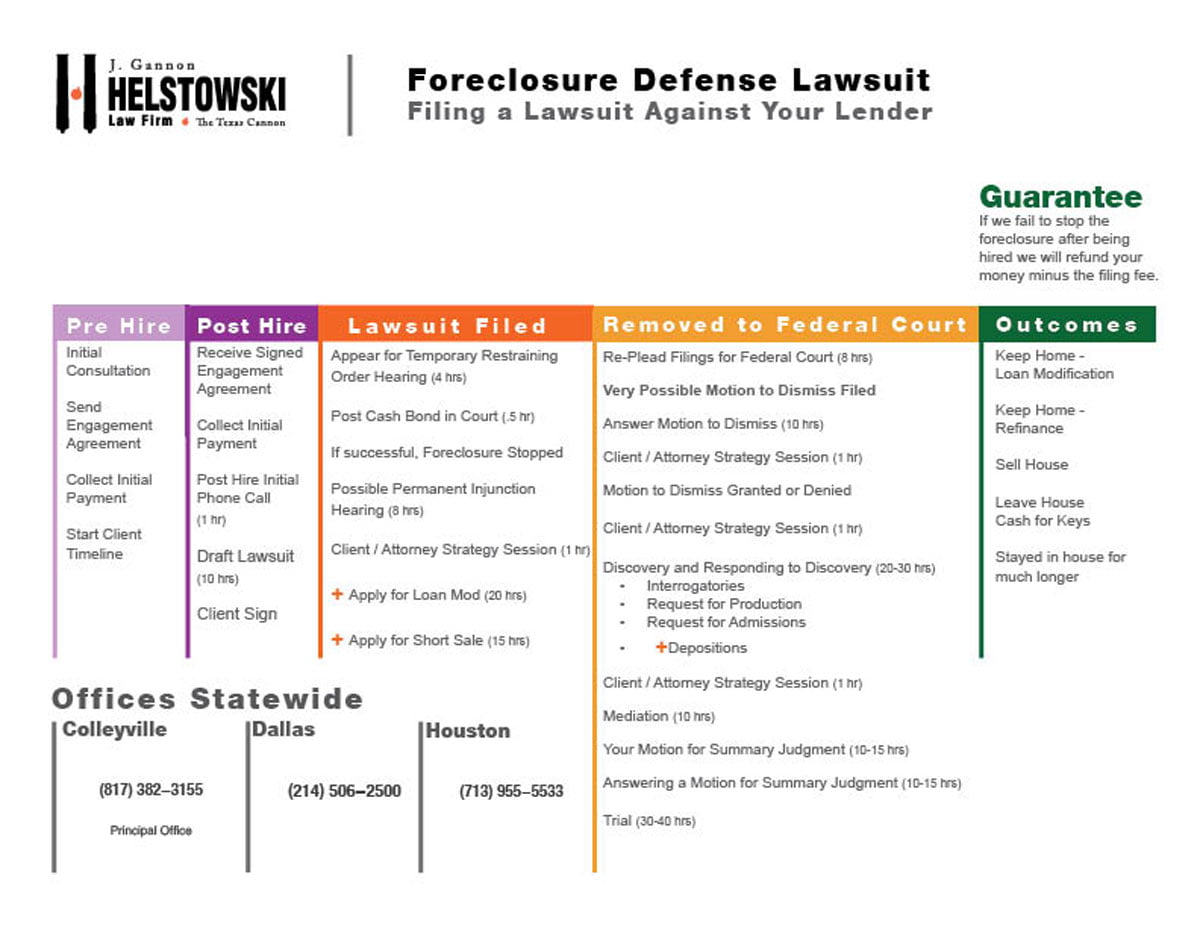

Many Texas homeowners choose to file a lawsuit against their lender in an attempt to stop a foreclosure rather than file a bankruptcy. The J. Gannon Helstowsi Law Firm files lawsuits against lenders and asks the judge to agree to stop the foreclosure. We offer a Money Back Guarantee that if we do not stop your foreclosure we will refund all the fees you paid us minus the filing fees of the lawsuit. We offer aggressive representation of you against your lenders.

While each stop foreclosure lawsuit is unique, most follow the same pattern:

File Stop Foreclosure Lawsuit

We will first gather all the details of your situation and make sure that we believe a successful outcome is possible in your case in our Initial Consultation (IC). If you decide to hire our firm you will be assigned a case manager and attorney to work your case. They will gather the documents needed from you and begin drafting your lawsuit. You will need to be available to answer questions and review a copy of your lawsuit before filing. Once filed, your assigned attorney will appear before a judge to request that a Temporary Restraining Order (TRO) be granted. If the judge signs the TRO, we will pay the bond and notice your lender that the foreclosure must be stopped.

Once the TRO is granted we will begin working hard for you to achieve a permanent resolution with your lender. Outcomes can include keep your home with a loan modification, keep your home with a refinance, sell your house and keep the equity, leave your house for cash for keys, or stay in your home for a longer duration.

Your Lawsuit is Removed to Federal Court

Often a lender will ask the judge to remove your case to Federal Court. If the judge agrees, it will cost more the pursue your claims against the lender. Federal court has many strict guidelines and rules that must be followed to keep your case alive. We will have to represent you in a couple of likely motions that the lender will file. We will answer the Motion to Dismiss and Motion for Summary Judgment for you if you retain us to represent you in Federal Court.

Lenders / Servicers We Stop Foreclosures

- AmeriHome Mortgage Company

- AmeriSave Mortgage Corporation

- Angel Oak Home Loans

- Arvest Bank

- Bank of America Home Loans

- Bank of England Mortgage ENG Lending

- Bank of Texas

- Bank of the West

- BankUnited, N.A.

- Bayview Loan Servicing

- BB&T Mortgage Servicing

- BBVA Compass

- Benchmark

- Caliber Home Loans

- Capital One Home Loans

- Carrington Mortgage Services, LLC

- Cascade Financial Services

- Cendera Funding, Inc.

- Cenlar FSB

- Chase

- CitiMortgage

- CMG Financial

- CNN Mortgage

- Colonial Banking and Home Loan

- Ditech

- Dovenmuehle Mortgage, Inc.

- East West Bank

- Envoy Mortgage

- EverBank

- Fay Servicing

- Fifth Third Bank

- Flagstar Bank

- Freedom Mortgage

- Gateway Mortgage Group

- Guardian Mortgage

- Guild Mortgage Company

- HomeBridge Financial Service

- Home Point Financial

- Huntington National Bank

- Intercap Lending Inc.

- InterLinc Mortgage Services, LLC

- James B. Nutter & Company

- J.G. Wentworth Home Lending

- KeyBank Mortgage

- Loan Care

- Midland Mortgage, a Division of MidFirst Bank

- Mr. Cooper (Nationstar)

- Nationwide Advantage Mortgage Company

- Nationwide Bank

- NewDay Financial LLC

- New American Funding

- On Q Financial, Inc.

- Penfed

- PennyMac

- PHH Mortgage

- Planet Home Lending, LLC

- Plaza Home Mortgage

- PNC Mortgage

- PrimeLending

- Primary Residential Mortgage

- Provident Funding Associates

- Pulte Mortgage

- Quicken Loans

- RoundPoint Mortgage Servicing Corporation

- Rushmore Loan Management Services

- SecurityNational Mortgage Company

- Service First

- ServiSolutions

- Shellpoint Mortgage Servicing

- Standard Mortgage

- Stearns Lending

- SunTrust Mortgage

- SWBC Mortgage Company

- Texas Bank Mortgage Co.

- The Money Source

- TIB – The Independent Bankers Bank

- Towne Mortgage Company

- TruHome Solutions, LLC

- Union Home Mortgage

- US Bank

- Wells Fargo

- Weststar Mortgage Corporation

- Zions Bancorp